The 25-Second Trick For Taxonomy

Wiki Article

Taxonomy Things To Know Before You Buy

Table of ContentsThe Single Strategy To Use For Tax Avoidance MeaningTax Amnesty Meaning Can Be Fun For EveryoneA Biased View of Tax As Distinguished From License FeeOur Tax StatementsThe Tax Amnesty 2021 PDFsFacts About Tax Amnesty 2021 RevealedTax Avoidance And Tax Evasion Can Be Fun For Everyone

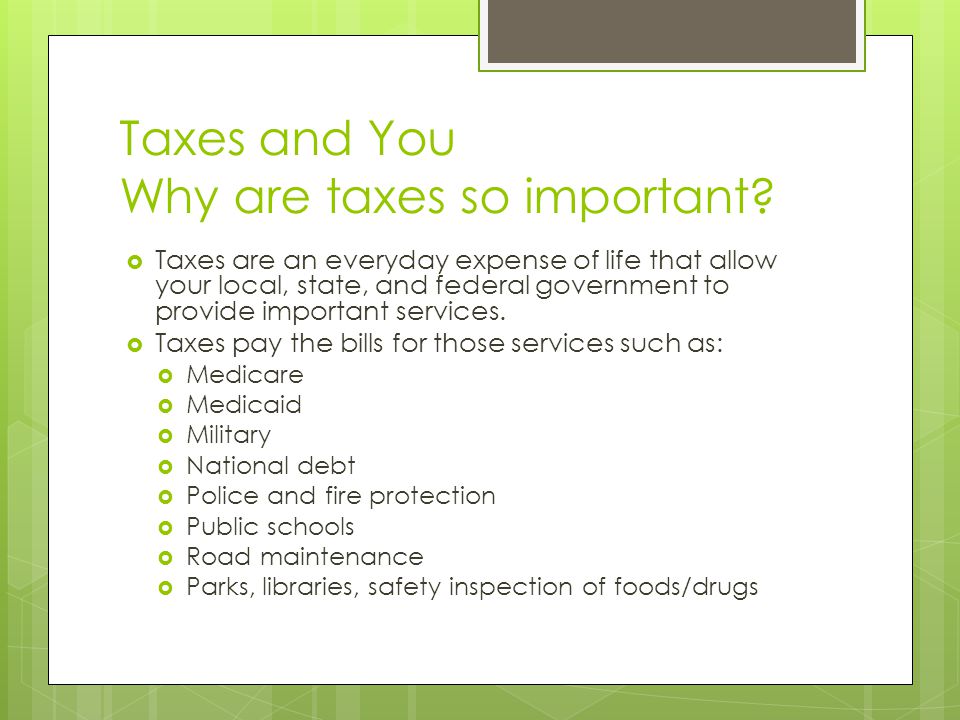

Further Reading, For more on revenue tax obligation, see this Northwestern Legislation College write-up and this University of Chicago Regulation Testimonial write-up.To meet their expenses, federal government need earnings, called "revenue," which it raises with tax obligations. In our nation, federal governments levy numerous different kinds of tax obligations on people and businesses.

The Definitive Guide to Tax Accounting

The capitalism system does not generate all the services required by culture. Some solutions are extra successfully provided when federal government companies plan as well as provide them. 2 fine examples are nationwide defense as well as state or regional police protection. Everyone gain from these solutions, as well as the most practical means to spend for them is via tax obligations, instead of a system of solution charges.These controls frequently add costs to the cost of new cars and trucks. There are likewise policies to regulate such things as the usage of billboards as well as indications along highways. Other policies manage redeeming land after strip mining, dumping commercial waste into streams and rivers, and also environmental pollution at airports. The free enterprise system is based upon competition amongst businesses.

To make certain that a degree of competition exists, the Federal Government applies stringent "antitrust" laws to avoid anybody from getting syndicate control over a market. Some solutions, called "all-natural monopolies," are more efficiently offered when there is competitors - tax as distinguished from license fee. The best-known examples are the utility firms, which provide water, natural gas, and electrical energy for house and company use.

The 6-Minute Rule for Tax Amnesty

The totally free business system thinks that consumers are well-informed concerning the high quality or safety of what they get. However, in our modern society, it is often difficult for customers to make educated choices. For public defense, government companies at the Federal, State, and also regional degrees issue and also enforce policies. There are guidelines to cover the top quality and safety and security of such points as home construction, automobiles, and also electrical home appliances.

An additional vital form of customer security is using licenses to protect against unqualified individuals from functioning in specific fields, such as medication or the structure professions. Our children get their education and learning primarily at public cost. City and area governments have the key responsibility for elementary and also additional education. The majority of states sustain colleges as well as colleges.

Federal grants made use of for carrying out research study are a vital resource of cash for schools. Given that the 1930s, the Federal Federal government has actually been giving income or solutions, frequently called a "safeguard," for those in requirement. Major programs include health services for the senior and also financial assistance for the handicapped as well as out of work.

Tax As Distinguished From License Fee Things To Know Before You Get This

Tax obligations in the USA Federal governments spend for these services with profits gotten by exhausting 3 financial bases: income, usage as well as riches. The Federal Government tax obligations earnings as its primary resource of revenue. State governments utilize tax obligations on income and usage, while regional governments depend nearly totally on taxing building and also wide range.A lot of the Federal Federal government's revenue comes from earnings taxes. The individual revenue tax obligation generates concerning 5 times as much profits as the company revenue tax obligation. Not all earnings tax exhausted in the very same means. For instance, taxpayers having stock in a corporation and afterwards selling it at a gain or loss must report it on a special routine.

By comparison, the rate of interest they earn on money in a normal interest-bearing account obtains included with salaries, you can find out more wages as well as other "regular" revenue. tax amnesty meaning. There are also lots of sorts of tax-exempt and tax-deferred financial savings prepares available that influence on people's tax obligations. Payroll tax obligations are a crucial source of earnings for the Federal Government.

The Main Principles Of Tax

Some state governments also make use of payroll tax obligations to pay for the state's unemployment settlement programs. Over the years, the quantity paid in social safety tax obligations has actually considerably increased.Tax obligations on Consumption The most essential tax obligations on consumption are sales and import tax tax obligations. Sales taxes generally obtain paid on such things as cars, garments and also movie tickets.

Examples of products subject to Federal import tax tax obligations are hefty tires, angling equipment, airplane tickets, gasoline, beer and liquor, guns, as well as cigarettes. The objective of import tax taxation is to position the burden of paying the tax on the customer. A great instance of this use import tax tax obligations is the fuel excise tax.

Not known Factual Statements About Tax Avoidance

Only individuals who buy fuel-- who utilize the freeways-- pay the tax. Some products obtain tired to inhibit their use.i was reading this The majority of regions tax obligation private homes, land, as well as service building based on the residential or commercial property's value. Usually, the taxes get paid monthly along with the home mortgage settlement.

Tax Amnesty 2021 - The Facts

Taxpayers might deduct a particular amount on their tax returns for each allowed "exception." blog here By lowering one's gross income, these exceptions and also deductions sustain the standard principle of straining according to capacity to pay. Those with high gross incomes pay a larger portion of their revenue in taxes. This percent is the "tax rate." Given that those with higher gross incomes pay a higher portion, the Federal earnings tax obligation is a "dynamic" tax obligation.Report this wiki page